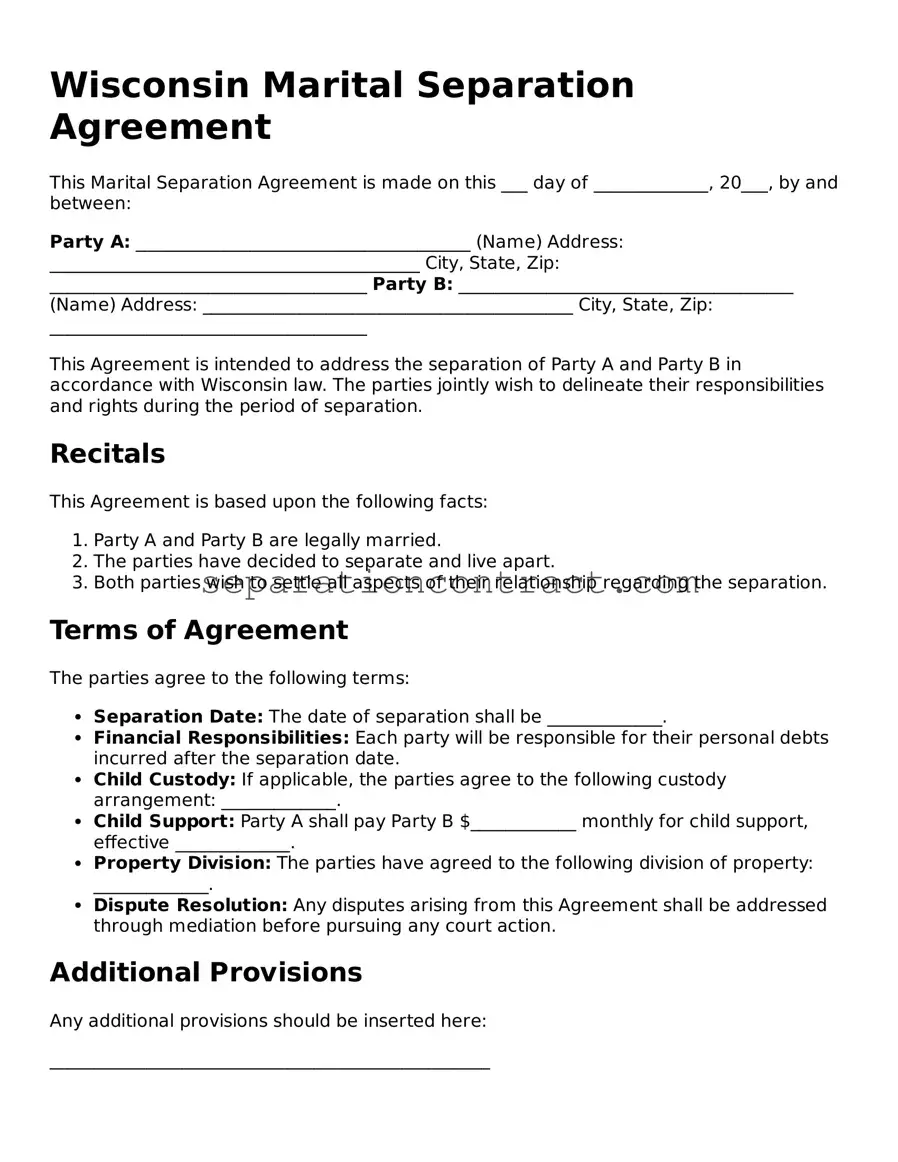

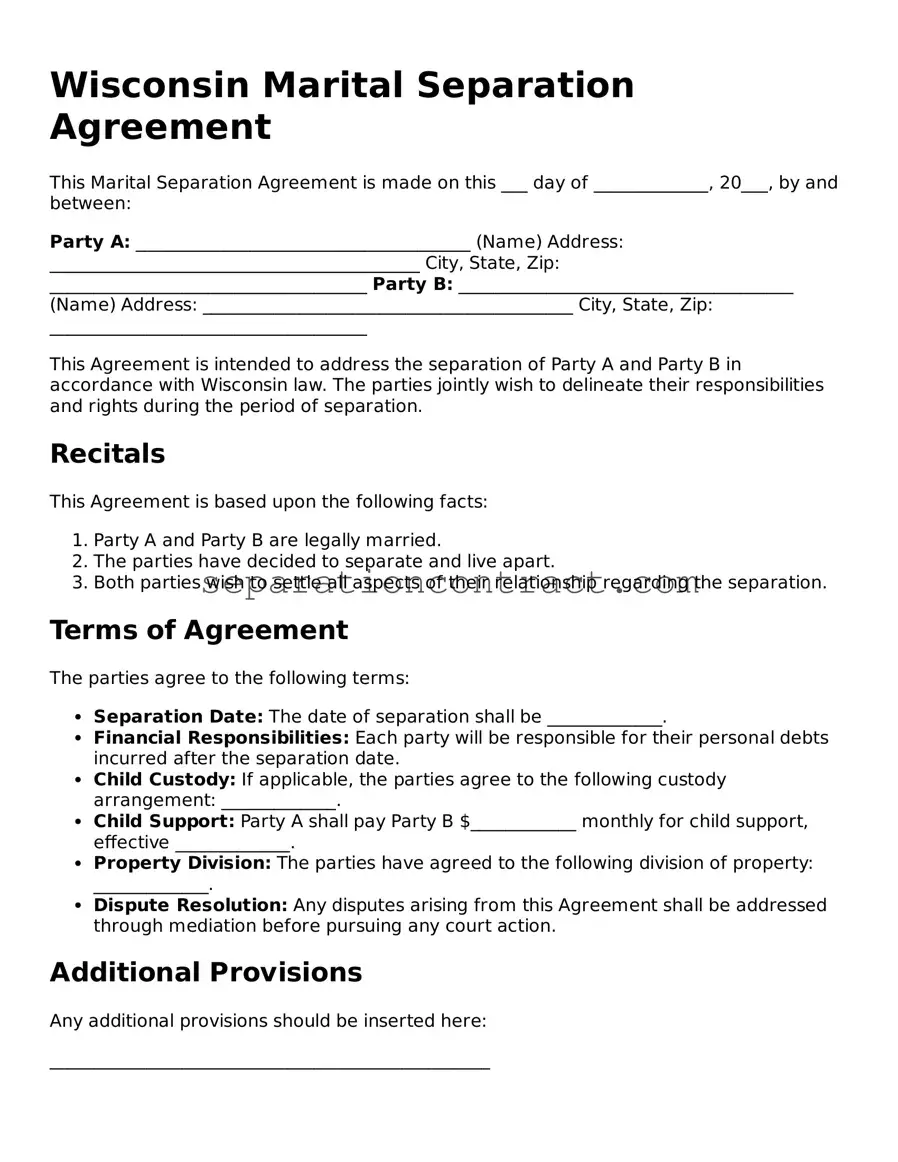

Valid Marital Separation Agreement Form for the State of Wisconsin

A Wisconsin Marital Separation Agreement is a legal document that outlines the terms and conditions agreed upon by spouses who wish to live apart while remaining legally married. This agreement covers important aspects such as property division, financial responsibilities, and child custody arrangements. Understanding this form is crucial for ensuring that both parties' rights and obligations are clearly defined during the separation process.

Take the first step towards clarity and peace of mind by filling out the form below.

Fill Out Your Form Online

Valid Marital Separation Agreement Form for the State of Wisconsin

Fill Out Your Form Online

Before exiting, complete the form

Finish your Marital Separation Agreement online — quick edits, easy save, instant download.

Fill Out Your Form Online

or

↓ PDF File